All Categories

Featured

State Ranch representatives sell everything from house owners to automobile, life, and other prominent insurance coverage items. So it's simple for agents to pack solutions for discounts and easy strategy management. Numerous customers delight in having actually one relied on agent handle all their insurance needs. State Farm provides universal, survivorship, and joint universal life insurance policy plans.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

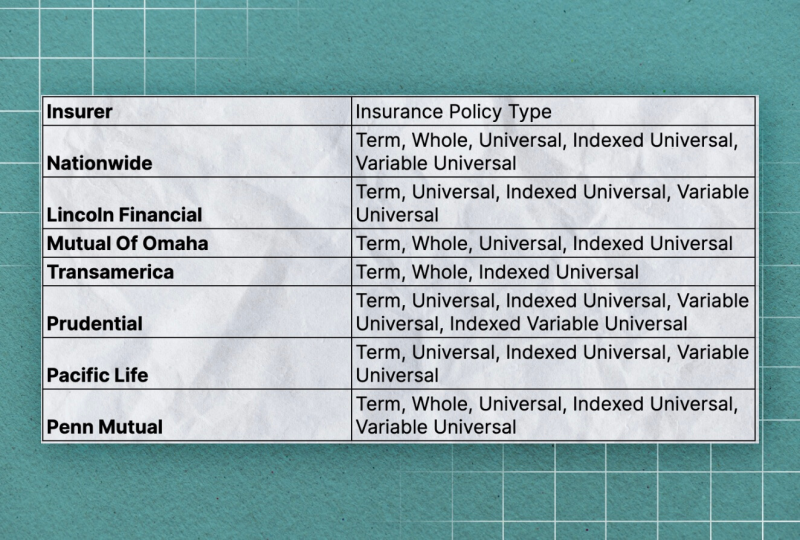

State Farm life insurance policy is usually conventional, offering stable alternatives for the average American family members. If you're looking for the wealth-building possibilities of global life, State Ranch lacks competitive choices. Read our State Ranch Life insurance policy testimonial. Nationwide Life Insurance sells all sorts of global life insurance: global, variable global, indexed universal, and global survivorship policies.

However it doesn't have a strong existence in other monetary items (like global strategies that unlock for wealth-building). Still, Nationwide life insurance policy strategies are highly easily accessible to American households. The application procedure can likewise be more convenient. It assists interested parties obtain their foot in the door with a trusted life insurance policy strategy without the much more complex conversations about investments, monetary indices, etc.

Nationwide fills the essential role of obtaining hesitant buyers in the door. Also if the most awful occurs and you can not get a larger strategy, having the protection of an Across the country life insurance policy plan could transform a purchaser's end-of-life experience. Review our Nationwide Life Insurance evaluation. Insurer use medical examinations to gauge your danger class when getting life insurance policy.

Purchasers have the alternative to change rates each month based on life circumstances. A MassMutual life insurance policy agent or financial advisor can assist purchasers make strategies with room for modifications to satisfy short-term and long-lasting economic objectives.

North American Universal Life Insurance

Some buyers might be stunned that it uses its life insurance coverage policies to the basic public. Still, armed forces participants appreciate distinct advantages. Your USAA policy comes with a Life Event Option cyclist.

VULs feature the greatest danger and the most prospective gains. If your plan doesn't have a no-lapse guarantee, you might even lose coverage if your cash value dips listed below a certain threshold. With so much riding on your investments, VULs need constant interest and upkeep. It might not be a terrific alternative for people that merely desire a fatality advantage.

There's a handful of metrics by which you can evaluate an insurance coverage firm. The J.D. Power consumer fulfillment rating is an excellent option if you desire a concept of how customers like their insurance plan. AM Finest's monetary strength score is one more essential statistics to consider when picking a global life insurance coverage firm.

This is particularly vital, as your cash money worth grows based on the investment alternatives that an insurance policy business uses. You must see what financial investment choices your insurance policy supplier offers and contrast it against the goals you have for your plan. The most effective means to find life insurance policy is to gather quotes from as many life insurance policy firms as you can to understand what you'll pay with each plan.

Latest Posts

Mutual Of Omaha Universal Life Insurance

Equity Indexed Life

Is An Iul A Good Investment