All Categories

Featured

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your busy life, economic freedom can appear like a difficult goal.

Pension plan, social safety, and whatever they 'd taken care of to save. However it's not that easy today. Fewer employers are supplying standard pension and several companies have reduced or terminated their retirement and your ability to rely entirely on social safety and security is in inquiry. Also if advantages haven't been lowered by the time you retire, social protection alone was never planned to be sufficient to pay for the way of living you desire and should have.

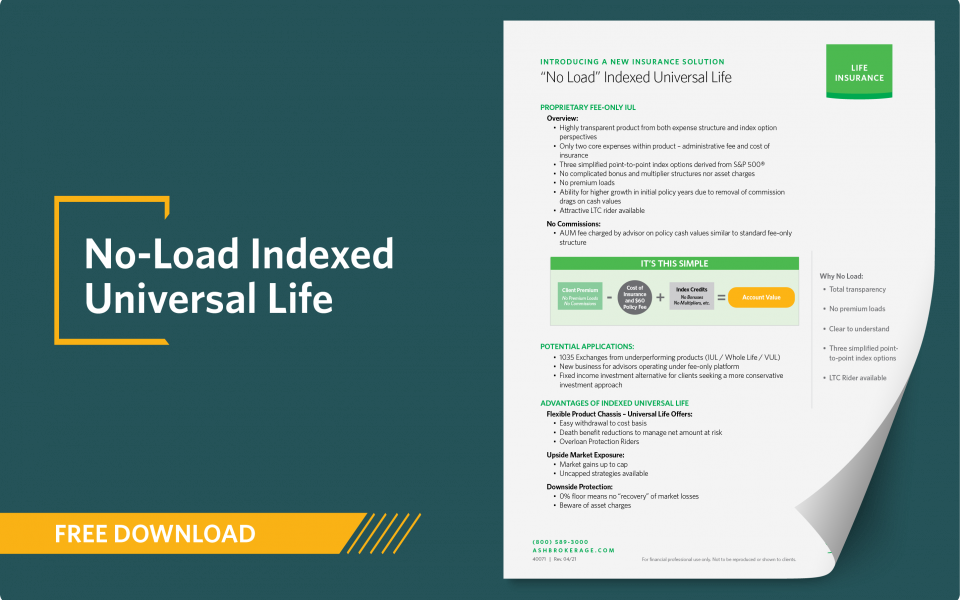

/ wp-end-tag > As part of a sound financial technique, an indexed universal life insurance coverage plan can assist

you take on whatever the future brings. Prior to dedicating to indexed universal life insurance coverage, below are some pros and cons to think about. If you choose an excellent indexed universal life insurance plan, you might see your cash worth grow in value.

North American Universal Life Insurance

If you can access it early on, it may be valuable to factor it right into your. Given that indexed universal life insurance policy needs a particular level of danger, insurance companies often tend to maintain 6. This kind of strategy also supplies (iul unleashed). It is still guaranteed, and you can change the face quantity and riders over time7.

Typically, the insurance firm has a vested rate of interest in carrying out far better than the index11. These are all elements to be considered when picking the finest type of life insurance coverage for you.

Indexed Life Policy

However, considering that this kind of plan is extra intricate and has a financial investment part, it can typically come with greater costs than other policies like entire life or term life insurance policy. If you do not assume indexed global life insurance is appropriate for you, below are some alternatives to take into consideration: Term life insurance policy is a short-term policy that commonly offers insurance coverage for 10 to 30 years.

When choosing whether indexed universal life insurance is ideal for you, it is very important to take into consideration all your alternatives. Entire life insurance may be a much better option if you are trying to find more security and uniformity. On the other hand, term life insurance coverage may be a much better fit if you just need protection for a particular time period. Indexed universal life insurance is a kind of plan that provides much more control and adaptability, together with greater cash value development potential. While we do not use indexed global life insurance policy, we can provide you with even more info concerning whole and term life insurance plans. We advise discovering all your options and chatting with an Aflac agent to find the very best fit for you and your family members.

The remainder is included in the money worth of the policy after costs are subtracted. The cash worth is credited on a month-to-month or annual basis with interest based upon boosts in an equity index. While IUL insurance policy may prove beneficial to some, it is very important to comprehend how it works prior to purchasing a policy.

Latest Posts

Mutual Of Omaha Universal Life Insurance

Equity Indexed Life

Is An Iul A Good Investment